Cryptocurrency investment has captured the attention of many, offering opportunities for financial growth and participation in a rapidly evolving digital economy. For beginners stepping into this dynamic space, understanding the fundamentals, risks, and strategies is crucial for making informed investment decisions. In this comprehensive guide, we’ll explore the essentials of investing in cryptocurrency, providing insights and tips for those new to the exciting world of digital assets.

Understanding Cryptocurrency

What is Cryptocurrency?

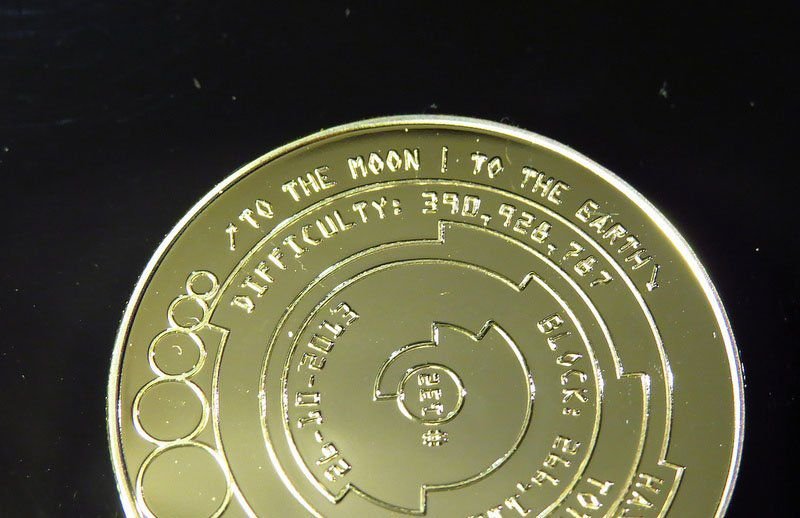

Cryptocurrency is a digital or virtual currency secured by cryptography, operating on decentralized networks called blockchains. Bitcoin was the pioneering cryptocurrency, followed by thousands of others, each with unique features and use cases.

Risks and Volatility

Cryptocurrency markets are highly volatile, experiencing rapid price fluctuations due to various factors such as market sentiment, regulatory news, and technological advancements. Understanding and accepting this volatility is crucial for investors.

Getting Started with Cryptocurrency Investment

Research and Education

Begin by researching different cryptocurrencies, understanding their underlying technology, use cases, and market dynamics. Resources like whitepapers, reputable websites, and community forums provide valuable insights.

Choosing a Reliable Exchange

Select a reputable cryptocurrency exchange to buy, sell, and trade digital assets. Consider factors like security measures, fees, available cryptocurrencies, and user interface when choosing an exchange.

Building a Diversified Portfolio

Diversification is key to managing risk in cryptocurrency investment. Consider allocating investments across different cryptocurrencies to spread risk and exposure to various assets.

Investment Strategies and Tips

Long-Term Holding (HODL)

Long-term holding, often referred to as “HODLing,” involves holding onto cryptocurrencies for an extended period, banking on their potential for long-term growth despite short-term volatility.

Dollar-Cost Averaging (DCA)

DCA involves regularly investing a fixed amount of money into cryptocurrencies, regardless of market fluctuations. This strategy helps reduce the impact of volatility on investment.

Risk Management and Due Diligence

Set clear investment goals and risk tolerance levels. Only invest what you can afford to lose and conduct thorough due diligence before investing in any cryptocurrency.

Staying Informed and Secure

Market Monitoring

Stay updated on market trends, news, and developments in the cryptocurrency space. Knowledge of market dynamics helps in making informed investment decisions.

Security Measures

Implement strong security practices, including using secure wallets, enabling two-factor authentication (2FA), and safeguarding private keys to protect your investments from potential threats.

Conclusion

Investing in cryptocurrency offers exciting prospects but comes with inherent risks. As a beginner, learning the basics, conducting thorough research, and adopting prudent investment strategies are crucial for navigating the volatile yet promising world of digital assets.

Remember, patience, due diligence, and continuous learning are essential when venturing into cryptocurrency investment. By staying informed, managing risks, and understanding the evolving landscape, beginners can embark on their cryptocurrency investment journey with greater confidence and knowledge.