-

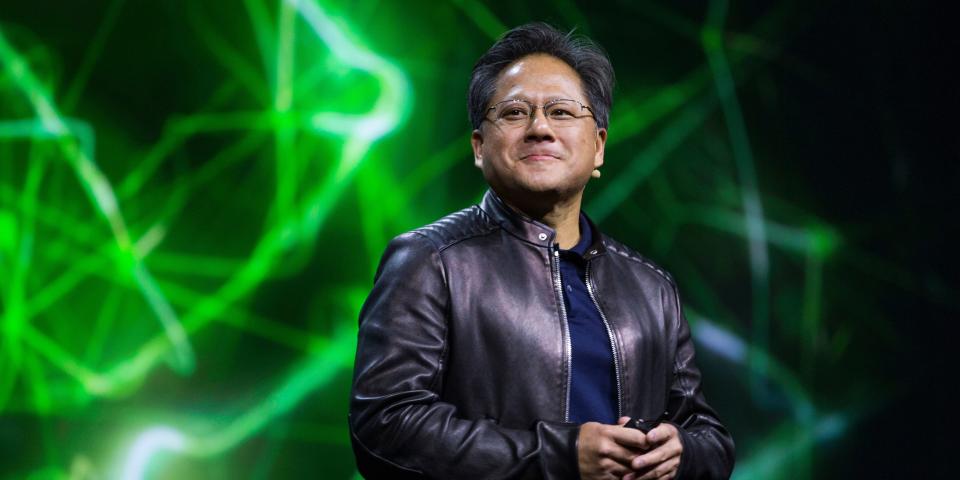

Nvidia reports earnings next week, and the chip maker’s results alone could swing the stock market.

-

This is according to Gene Munster of Deepwater, who cited Wall Street’s craze over AI.

-

“All eyes are on their data center number,” he told CNBC.

Next week’s Nvidia earnings report could swing the overall stock market higher as Wall Street continues to focus on growth in AI technology, according to Gene Munster of Deepwater Asset Management.

The chipmaker, which supplies processors that are central to the development of artificial intelligence, will release second-quarter results after the close on August 23.

“We need to think a lot about Nvidia, because as Nvidia goes, AI goes, and so does Nasdaq.” Munster told CNBC.

Shares rose 1.9% on Tuesday, bucking the broader decline in the stock market, and are up more than 200% since the start of the year. The Nasdaq has gained 30% this year, led by artificial intelligence stocks such as Nvidia.

“All eyes are on their data center number,” Munster added, noting that Wall Street estimates Nvidia’s revenue from this segment is $8 billion. “If they get above that, that will send the broader market higher, and the broader Nasdaq index. If they come in line, that will be disappointing.”

He agreed with a note from Morgan Stanley on Monday that predicted Nvidia would beat quarterly expectations and raise guidance.

Munster also noted that Nvidia’s CFO spoke at a conference call in late June, just before management entered a quiet period leading up to the earnings report.

During the event, Nvidia highlighted strong demand around the world and dismissed concerns about the impact of trade restrictions between the US and China, according to Munster.

“That’s a very strong hold in the lull, and I think eventually they’ll deliver that,” he said.

To put Nvidia’s estimated $8 billion data center revenue in the second quarter in more context, that would be up more than 110% from last year, he noted.

Meanwhile, Microsoft posted total revenue gains for the fiscal fourth quarter of 10% in constant currency and 17% in its cloud business.

“This is the apples and oranges when it comes to leadership in AI,” Munster said.

Read the original article at Business interested